Written By: Janine Kick

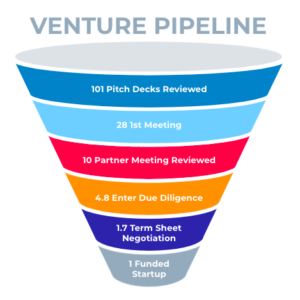

A recent study from Harvard Business Review found that for each deal a VC firm closes, the firm considers on average 101 opportunities. Of those, 28 will lead to a first meeting, 10 will be reviewed at a partner meeting, 4.8 will proceed to due diligence, 1.7 will move on to term sheet negotiations, and only 1 will actually be funded. The typical deal takes 83 days to close and firms report spending over 100 hours on due diligence during that period, making calls to on average, 10 references.

Clearly, VCs reject far more startups than they accept. On the other hand, a VC can also become exceptionally aggressive when they spot a company they like.

So, what makes a VC enter the ring?

You.

95% of VC firms cited the founding management team as the most important factor in pursuing a deal. Peter Theil coined it, “We live and die by our founders” but let’s be honest, Founder’s Fund isn’t the only one living this truth…

From here, 74% of firms stated the business model as an important factor, 68% said the market, and 31% claimed the industry.

So maybe it isn’t all jockey over horse, but it is a whole lot of jockey…

What this tells us is that inspiring entrepreneurs with a smart business model in a sizable market create the most competition for themselves. A founder that has a clear message on what the company will and will not do and how they will approach their bold vision is key.

From my perspective, playing middle-(wo)man day in and day out, what it comes down to is presence. You don’t have to be the loudest or most vocal but you do have to have moxie and the ability to demonstrate confidence to your team and investors if you want to be 1 in 101.

Kerosene Ventures – Helping Great Founders Raise Capital